LTCi: Growing number of options available to fit client needs

Life insurance with either long-term care riders or chronic illness riders are picking up steam in the marketplace, said Steve Cain, national sales leader with LTCI Partners.

Cain spoke about the rising interest in hybrid life policies during the National Association of Insurance and Financial Advisors Peak 65 Impact Day.

“Most clients like the idea of a dual-purpose policy,” he said. “Life with chronic illness rider is seeing the lion’s share of the new business written but I still think there’s a time and a place for traditional long-term care insurance.”

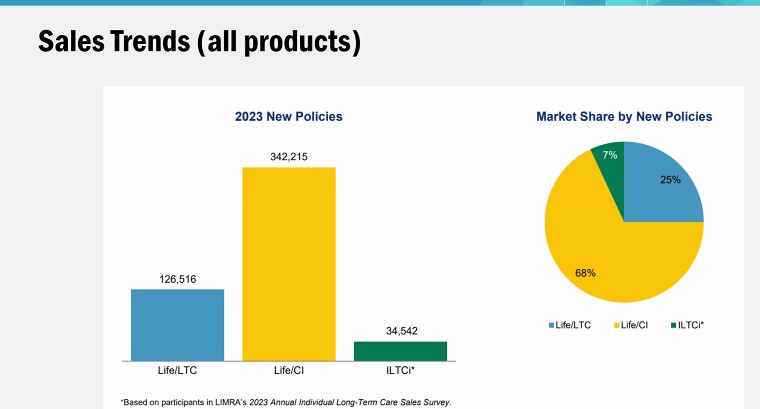

Cain cited LIMRA’s 2023 annual individual long-term care sales survey, which showed that 68% of new policies sold that year – more than 342,000 policies – were life/chronic illness combination policies. Twenty-five percent – about 126,000 policies – were life/LTC combinations while only 7% – about 34,000 policies – of new sales were traditional individual LTCi.

Consumers have several LTCi planning solutions available to them, Cain said. Those solutions include:

- Short-term care insurance.

- Traditional LTCi.

- Hybrid life plus qualified long-term care insurance.

- Life insurance with chronic illness/accelerated death benefit or QLTCi riders.

- Annuities with LTC riders.

Short-term care insurance is growing in popularity, he said. These policies may be suitable for an older client who has some health concerns. Discussing STC with an older client would be a complimentary discussion to a Medicare conversation.

Hybrid life and annuities with LTC riders are seeing some growth in the marketplace, Cain said. “Our job is to look through these and find the right solutions for your clients,” he said.

Cain said that to find the product that is the best fit for a client, advisors must ask the following:

- What is the client’s health condition?

- How much coverage does the client need now and at age 85?

- Does the client need life insurance?

- What is the client’s budget?

- Is the client comfortable paying for a “pure protection” product?

- Are premium guarantees important to the client?

Buying long-term care coverage is “a mind share and a wallet share issue,” Cain said.

“I have to think about protecting my family, but beyond that, I have to be able to afford it.”

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post LTCi: Growing number of options available to fit client needs appeared first on Insurance News | InsuranceNewsNet.