Corebridge Financial rides RILA rollout success amid choppy Q1 waters

Corebridge Financial completed its first full quarter selling a registered index-linked product and the Q1 results were excellent, CEO Kevin Hogan said Wednesday.

Introduced in October, the MarketLock RILA made Corebridge the biggest annuity seller to offer products in every major category. The insurer recorded $260 million in RILA sales during the first quarter, Hogan told Wall Street analysts Tuesday.

“We are now actively selling through our largest distribution partners, and after launching in California last month, are admitted in all but two states,” he added. “Looking forward, we are well positioned in the fast-growing RILA market, given our strong product, broad reach and long-tenured relationships.”

According to LIMRA’s most-recent data, Corebridge ended 2024 in a familiar position: No. 2 behind Athene Life & Annuity with $26.6 billion in annuity sales for the year.

A RILA is a long-term, tax-deferred insurance contract that’s designed to help people save for retirement. RILAs work by tying the performance of the contract to one or more stock market indexes, and offering a level of protection from market downturns.

Corebridge employs a “lock strategy” that locks and credits a rate based on actual S&P 500 index performance on the day the preset growth target is reached. Once the gains are locked in, consumers are guaranteed a fixed rate of interest until the next contract anniversary, when they can transfer assets to any available MarketLock strategy account option.

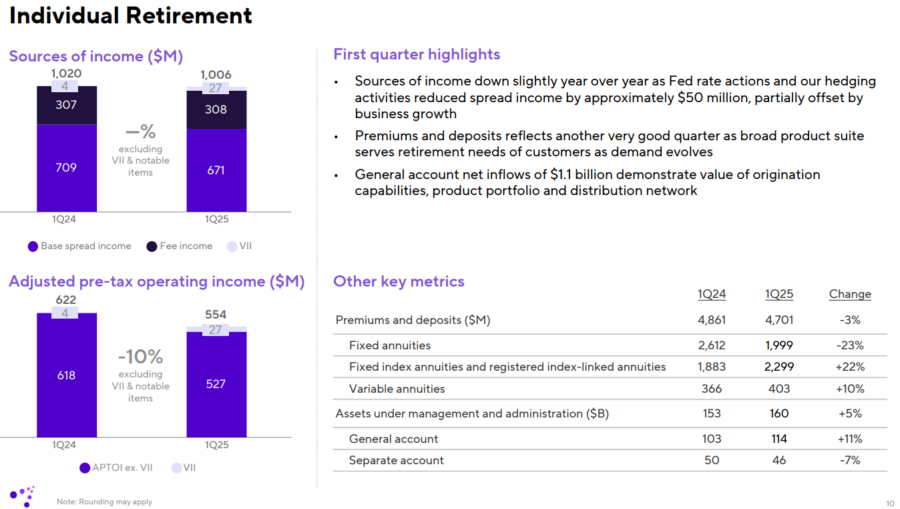

Corebridge premiums and deposits declined 12% to $9.3 billion in Q1. However, Hogan noted the exceptionally strong year-ago quarter of $10.5 billion. Otherwise, fixed annuity deposits were down, partially offset by the RILA sales.

Hogan dismissed concerns, citing the market demand and the full Corebridge product suite.

“In the fourth quarter and the first quarter, there were a few periods of lower sales in the face of some of the market changes,” Hogan explained. “But I wouldn’t read too much into that. We see very strong demands continuing for the index products, in particular.”

In Other News:

Analysts peppered Hogan and Chief Financial Officer Elias Habayeb on a number of company topics:

Reinsurance outlook. During the second quarter 2024, Corebridge received regulatory approval to cede business to its Bermuda reinsurer. Since then, the insurer worked steadily on its “Bermuda strategy,” Hogan said.

“We continue to expand our Bermuda strategy, which is an important part of our capital management toolkit,” he said. “We added additional $2 billion of reserves this quarter. So, we’ve ceded $14 billion with the new strategy to date. … We see further opportunities for both in-force and and new business cessions.”

Surrenders. Habayeb warned analysts during Corebridge’s last earnings call that surrenders would likely be increasing due to “large lots of fixed and fixed index annuities exiting the surrendered charge period.”

That remains the projection for the second half of the year, Hogan said, and is indicative of the “significant growth” in the Corebridge annuity business. On the bright side, the conditions that promote annuity surrenders also promote new business, he noted.

“What we’re focused on is the long-term growth of our general account, net of any surrenders,” Hogan said. “We look at options as to how we may preserve surrenders. But more importantly, we look at new business pricing, and new business pricing is very attractive.”

Nippon Life prospects. Corebridge is the former AIG Life & Retirement business and wrapped up a years-long separation in 2024. It also took on a $3.8 billion investor in Nippon Life, Japan’s largest life insurer, last year. The two companies have not revealed any joint efforts, but Hogan didn’t rule it out.

“We operate in very different markets, and we have a lot that we can learn from each other,” Hogan said. “We’re taking in a structured approach to looking at what are the various areas in which we may be able to generate some mutually beneficial activities.”

M&A deals. There is little indication that economic volatility is going to cause merger-and-acquisition activity to slow down, Hogan said. Responding to a question about pension risk transfer options, Hogan noted the “very robust” market, but said Corebridge is focused on plan terminations as well.

“For quite some time we’ve been focused on full-plan terminations, which are transactions generally in region of $500 million to [$1.5 billion],” he said. “We carefully underwrite these. They’re essentially like mini M&A transactions, where we have to carefully evaluate both liabilities and asset strategies.”

M&A opportunities “are not predictable,” Hogan added, but the market remains strong in both the United States and the United Kingdom.

Quarterly Snapshot:

- Group Retirement premiums and deposits decreased $230 million, or 11%, from the prior-year quarter primarily driven by lower out-of-plan annuity deposits.

- Life Insurance premiums and deposits decreased $238 million, or 22%, from the prior-year quarter driven by the sale of the international life business.

- Institutional Markets premiums and deposits decreased $644 million, or 25%, from the prior-year quarter primarily driven by lower premiums from pension risk transfer transactions, partially offset by higher deposits from guaranteed investment contracts.

Management Perspective:

“We are investing in digital capabilities, expanding our product offerings and deepening relationships with our distribution partners, while also developing new channels in individual retirement. We continue to benefit from favorable market and demographic conditions, producing premiums and deposits of $4.7 billion.”

CEO Kevin Hogan

By The Numbers:

- Operating Income: Adjusted after-tax operating income of $649 million ($688 million in Q1 2024)

- Net Income: -$664 million ($878 million in Q1 2024)

- Earnings Per Share: $1.16 ($1.10 in Q1 2024)

- Share Repurchases: $321 million

- Dividend Declared: $0.24 per share of common stock

- Stock Price Movement: Shares up more than 4% Tuesday afternoon to $31.83.

Life Picture:

– Premium and Deposits: $856 million ($1.1 billion in Q1 2024)

– Operating Income: $108 million ($54 million in Q1 2024)

Annuity Picture:

– Premium and Deposits: $4.7 billion ($4.9 billion in Q1 2024)

– Operating Income: $554 million ($622 million in Q1 2024)

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Corebridge Financial rides RILA rollout success amid choppy Q1 waters appeared first on Insurance News | InsuranceNewsNet.