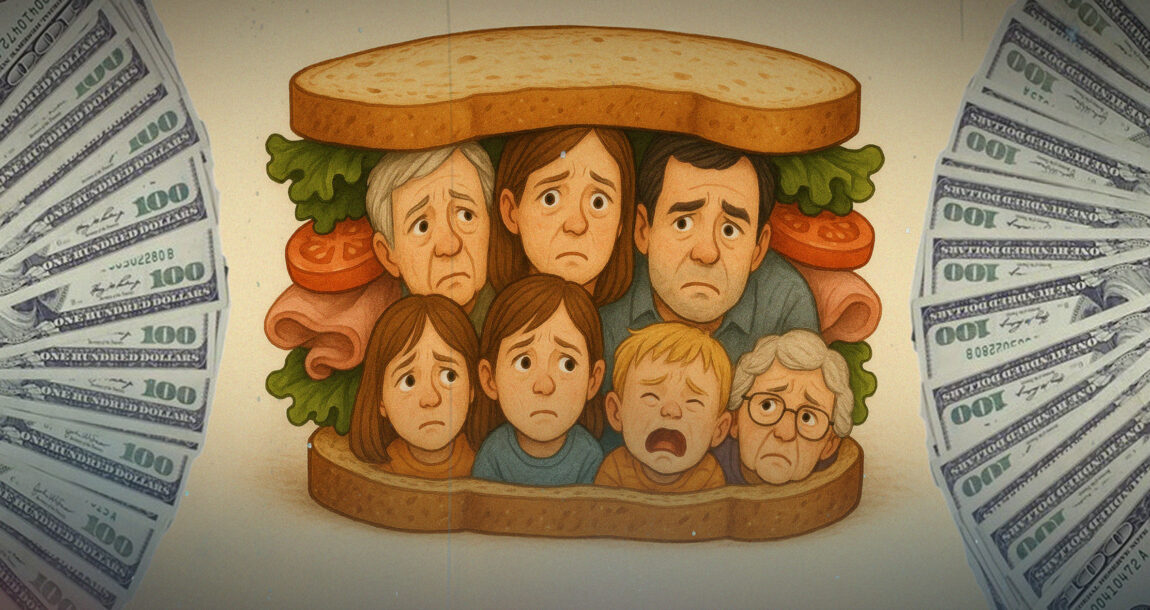

‘Sandwich Generation’ pressures derail retirement plans for millions, study finds

Members of the “Sandwich Generation” – Americans who have both young children and aging parents – are struggling to stay on track toward their retirement and long-term financial goals, according to the 2025 Annual Retirement Study from the Allianz Center for the Future of Retirement.

One in four Americans (25%) has a child who is under 18 and a living parent, and is part of the sandwich generation, with the dual responsibility of caring for their own children as well as their aging parents, the survey explained. Nearly half of millennials (46%) and 18% of Gen Xers are part of this sandwich generation.

Most Americans in the sandwich generation are providing their parents with either physical, financial or emotional support. “Caring for both your young children and your aging parents can be overwhelming for both your time and your finances,” said Kelly LaVigne, VP of consumer insights, Allianz Life. “While you may feel it is your responsibility to care for everyone, it’s important to keep your own best interest in mind for your long-term security. Forgoing your own retirement savings now can have costly consequences later on.”

Carrying out dual caregiving responsibilities can have costly consequences later in life. In fact, this is one of the more concerning responses from the survey. As LaVigne, explained, according to 2025 Annual Retirement Study from the Allianz Center for the Future of Retirement, more than half (59%) of those in the sandwich generation responded that they have reduced or stopped contributing to their retirement account.

“While I can sympathize that they may need every penny for their current situation, this can be short-sighted,” LaVigne added. “Losing the company match (if they have it) is losing free money that could make the critical difference in their retirement future. Also, the truism that says: “it’s not timing the market, it’s time IN the market” is so important a concept for retirement planning. They may be surprised that the amount they stop contributing to their pre-tax retirement plan may not, because of the tax advantage, add that much to their net take home pay.”

Helping clients balance their responsibilities

So, what are some of the steps a financial professional can take to help his clients create a strategy designed to balance their current responsibilities with their financial future?

“The reason why we encourage savers to seek the advice of a financial professional is that they have a myriad of resources to help plan out a financial plan AND it is their full-time job, “LaVigne said in response to this important question. “They can look at different risk levels, find programs that can help with the care of children and elderly parents, and also tap into their network of business connections that the average individual might not have available. They can help draft a plan that will possibly avoid some of the consequences of having extra financial burdens and also save their clients’ time by doing the research for them.”

Risk-management strategies

And what additional risk-management strategies can a financial professional use to help his clients develop a financial plan that ensures that their money lasts as long as they do? Since everyone’s retirement objectives are different, there is no one-size-fits-all strategy, LaVigne pointed out. “But with the advent of Buffered ETFs, loans from permanent life insurance, and fixed indexed annuities (FIAs) and Registered Indexed Linked Annuities (RILA), financial advisors have many tools at their disposal that they can utilize in a diversified plan that can help with growth, protections and appropriate risk.”

Allianz Center for the Future of Retirement, t, part of Allianz Life Insurance Company of North America (Allianz Life), conducted an online survey, the 2025 Annual Retirement Study, in January/February 2025, with a nationally representative sample of 1,000 respondents age 25+ in the contiguous U.S. with an annual household income of $50k+ (single) / $75k+ (married/partnered) OR investable assets of $150k+.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post ‘Sandwich Generation’ pressures derail retirement plans for millions, study finds appeared first on Insurance News | InsuranceNewsNet.