Q1 annuity sales veer off record pace, remain solidly strong, Wink finds

Annuity sales might have peaked, judging by the still-strong first-quarter sales data released Friday by Wink, Inc.

Total Q1 sales for all annuities were $98.2 billion, according to Wink’s Sales and Market Report, down 1.9% compared to the previous quarter and down 5.7% compared to the same period last year. All annuities include the multi-year guaranteed, traditional fixed, indexed, structured, variable, immediate income, and deferred income annuity product lines.

The dip continues, a trend that Wink recorded in the fourth quarter.

Noteworthy highlights for all annuity sales in the first quarter include Athene USA ranking as the No. 1 carrier overall for annuity sales, with a market share of 9.7%. New York Life came in second place, while Equitable Financial, Corebridge Financial, and Allianz Life completed the top five carriers in the market, respectively.

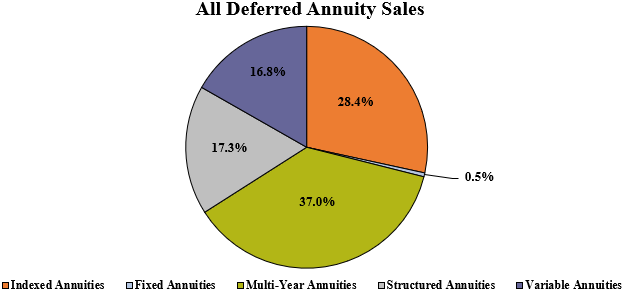

Total first-quarter sales for all deferred annuities were $95 billion, down 1.6% when compared to the previous quarter and down 5.4% compared to the same period last year. All deferred annuities include the multi-year guaranteed annuity, traditional fixed, indexed annuity, structured annuity, and variable annuity product lines.

Noteworthy highlights for all deferred annuity sales in the first quarter include Athene USA ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 10%. New York Life moved into the second-ranked position, while Equitable Financial, Corebridge Financial, and Allianz Life, completed the top five carriers in the market, respectively.

Equitable’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling deferred annuity, for all channels combined, in overall sales for the second consecutive quarter.

Total first quarter non-variable deferred annuity sales were $62.7 billion, up 1.7% when compared to the previous quarter and down 14.6% when compared to the same period last year. Non-variable deferred annuities include the MYG annuity, traditional fixed annuity, and indexed annuity product lines.

Noteworthy highlights for non-variable deferred annuity sales in the first quarter include Athene USA ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 14.6%. New York Life took the second-ranked position, while Corebridge Financial, Sammons Financial Companies, and Global Atlantic Financial Group completed the top five carriers in the market, respectively.

Athene Annuity’s Athene MYG 5 with MVA, a MYG annuity, was the No. 1 selling non-variable deferred annuity for the quarter, for all channels combined, in overall sales for the quarter.

Total first quarter variable deferred annuity sales were $32.3 billion, down 7.7% when compared to the previous quarter and up 19.3% when compared to the same period last year. Variable deferred annuities include structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the first quarter include Equitable Financial ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 17%. Jackson National Life continued in the second-place position, as Lincoln National Life, Prudential, and Allianz Life completed the top five carriers in the market, respectively.

Equitable’s Structured Capital Strategies Plus 21, a structured annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the fourth consecutive quarter.

Total first quarter income annuity sales were $3.1 billion, down 10.3% when compared to the previous quarter and down 13.2% compared to the same period last year. Income annuities include immediate income annuity (SPIA) and deferred income annuity (DIA) product lines.

Noteworthy highlights for income annuity sales in the first quarter include New York Life ranking as the No. 1 carrier overall for income annuity sales, with a market share of 43.7%. Western-Southern Life Assurance Company continued in the second-ranked position, as Massachusetts Mutual Life Companies, Nationwide, and Penn Mutual completed the top five carriers in the market, respectively.

Multi-year guaranteed annuity sales in the first quarter were $35.2 billion, up 20.8% when compared to the previous quarter, and down 19.5% compared to the same period, last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the first quarter include Athene USA ranking as the No. 1 seller, with a market share of 16.3%. New York Life moved into the second-ranked position, while Corebridge Financial, Pacific Life Companies, and Global Atlantic Financial Group concluded as the top five carriers in the market, respectively.

Athene Annuity’s Athene MYG 5 with MVA product was the No. 1 selling multi-year guaranteed annuity, for all channels combined, for the quarter.

Sheryl Moore, CEO of both Wink, Inc., and Moore Market Intelligence, said, “It is unusual to see sales increase from the fourth quarter to the first quarter of the next year. Apparently, someone should have given the memo to the insurers offering MYGAs.”

Traditional fixed annuity sales in the first quarter were $496.5 million, up 1% when compared to the previous quarter, and down 9.1% compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the first quarter include Global Atlantic Financial Group ranking as the No. 1 seller, with a market share of 14.2%. Nationwide ranked second, while Modern Woodmen of America, National Life Group, and CNO Companies concluded as the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined, for the nineteenth consecutive quarter.

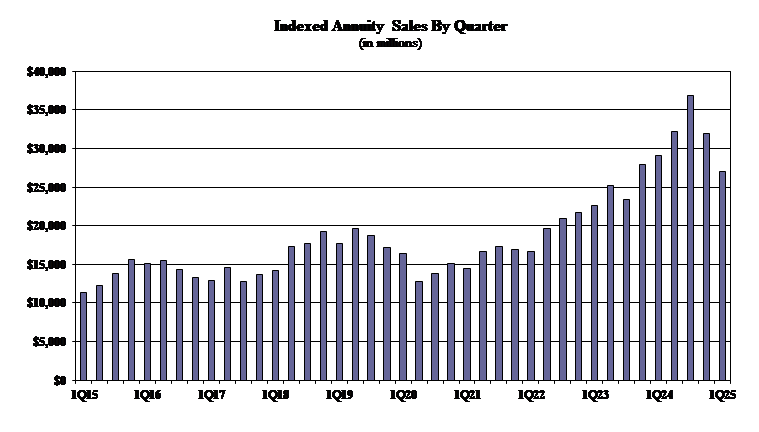

Indexed annuity sales for the first quarter were $27 billion, down 15.6% when compared to the previous quarter, and down 7.2% compared with the same period last year. Indexed annuities have a floor of no less than 0% and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for indexed annuities in the first quarter include Athene USA ranking as the No. 1 seller, with a market share of 12.6%. Sammons Financial Companies ranked second, while Allianz Life, Corebridge Financial, and American Equity Companies completed the top five carriers in the market, respectively. American Equity’s IncomeShield 10 was the No. 1 selling indexed annuity, for all channels combined, for the second consecutive quarter.

Structured annuity sales in the first quarter were $16.4 billion, down 4.7% compared to the previous quarter, and up 17.7% compared to the same period last year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the first quarter include Equitable Financial ranking as the No. 1 seller, with a market share of 21.5%. Allianz Life ranked second, while Prudential, Brighthouse Financial, and Lincoln National Life completed the top five carriers in the market, respectively. Equitable’s Structured Capital Strategies Plus 21 was the No. 1 selling structured annuity, for all channels combined, for the fourth consecutive quarter.

“While structured annuities have been around for more than a decade, we are still seeing new entrants regularly,” Moore said. “It is amazing how the sales trajectory has mirrored that of indexed annuities.”

Variable annuity sales in the first quarter were $15.9 billion, down 10.5% compared to the previous quarter, and up 21.1% compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses is determined by the performance of subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the first quarter include Jackson National Life ranking as the No. 1 seller, with a market share of 16.7%. Equitable Financial ranked second, while Lincoln National Life, New York Life, and Nationwide finished as the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the twenty-fourth consecutive quarter, for all channels combined.

“While variable annuity sales are up over this time last year, I wouldn’t be expecting that trend to continue with the recent volatility in the markets,” explained Moore.

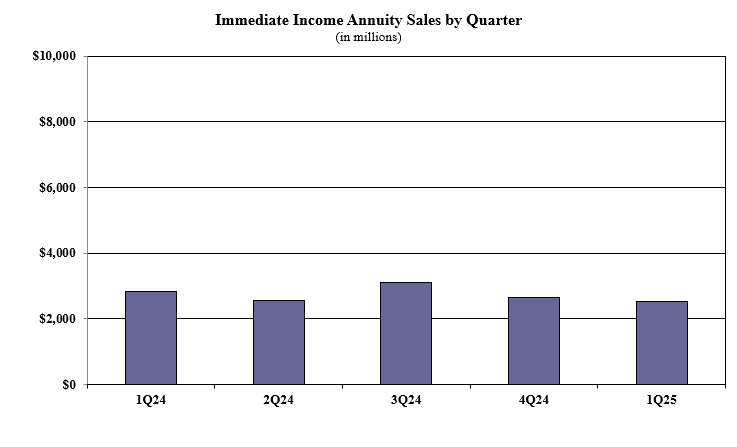

Immediate income annuity sales in the first quarter were $2.5 billion, down 4.6% as compared to the previous quarter and down 11.4% as compared to the same period last year.

Noteworthy highlights for SPIAs in the first quarter include New York Life ranking as the No. 1 seller, with a market share of 43.2%. Massachusetts Mutual Life Companies ranked second, while Nationwide, Western-Southern Life Assurance Company, and Penn Mutual finished as the top five carriers in the market, respectively.

Deferred income annuity sales in the first quarter were $672 million, down 26.7% compared to the previous quarter and down 19% compared to the same period last year.

Noteworthy highlights for DIAs in the first quarter include New York Life ranking as the No. 1 seller, with a market share of 45.8%. Western-Southern Life Assurance Company ranked second, as Massachusetts Mutual Life Companies, Integrity Life Companies, and Global Atlantic Financial Group finished as the top five carriers in the market, respectively.

Wink now reports sales on all annuity lines of business, as well as all life insurance product lines, Moore noted in a news release.

The post Q1 annuity sales veer off record pace, remain solidly strong, Wink finds appeared first on Insurance News | InsuranceNewsNet.