NAIC counters climate impacts with new working groups, risk dashboard

The National Association of Insurance Commissioners (NAIC) is retooling efforts to improve climate change modeling and be better prepared for its impacts on the insurance industry.

That effort includes new charges for 2026 and a newly streamlined workflow. The NAIC decided to restructure and consolidate the existing Climate and Resiliency Task Force, the Catastrophe Insurance Working Group and the NAIC/Federal Emergency Management Agency Working Group into the new Natural Catastrophe Risk and Resilience Task Force.

Two new working groups will have more defined focus areas: the Pre-Disaster Mitigation & Risk Modeling Working Group and the Severe Peril Working Group. NAIC has stepped up efforts to battle climate change in recent years.

“We are reinforcing our catastrophe, risk and resiliency expertise to better serve our states and communities,” said California Insurance Commissioner Ricardo Lara. “We are also seeing a growing number of states with risk mitigation grant programs. This task force will help those programs maximize risk reduction and improve insurability.”

Regulators want to expand their focus to study climate change impacts comprehensively, Lara said. For example, extreme cold winter storms has been added as a priority.

“These events … have produced multi-billion dollar insured losses, reshaped state insurance markets where they have occurred, and also underscored the urgent need for resilient infrastructure and, of course, consumer protections,” Lara added.

Co-chair of the Climate and Resiliency Task Force with Louisiana Insurance Commissioner Tim Temple, Lara spoke last week during the task force meeting at the NAIC fall meeting in Hollywood, Fla.

Temple discussed the Natural Catastrophe Risk Dashboard Report, a new climate impact report developed by a drafting group of 12 states to give regulators data to help assist in closing protection gaps.

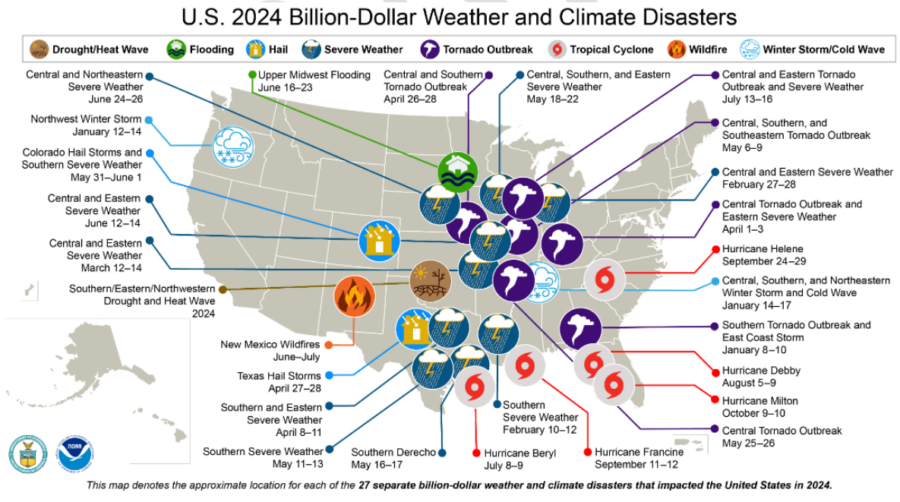

The climate impact report identified 27 confirmed weather/climate disaster events with losses exceeding $1 billion each. These events included one drought event, one flooding event, 17 severe storm events, five tropical cyclone events, one wildfire event, and two winter storm events. Overall, these events resulted in the deaths of 568 people.

In 2023, 28 billion-dollar weather/climate disaster events occurred, the highest number since 1980. The 1980–2024 annual average is nine such events, the NAIC reported.

“This project was developed … to give regulators data on national metrics meant to understand issues of catastrophe impacts on the insurance market and how these impacts can lead to protection gaps,” Temple said.

The task force held a regulator-only meeting on Nov. 19, where it adopted the dashboard for regulator use, Temple added.

The task force extended the period for public comment on the new report another 10 days until Jan. 12. David Snyder is vice president of international policy for the Property Casualty Insurers Association of America.

“We want to very much express appreciation for consideration of mitigation, because we believe, and your state is a classic example, that that is the real way to affordability and availability,” he said in the only public comment during the meeting.

Mitigation focuses on reducing hurricane/wind damage via shutters, roof bracing, elevation, and limiting water damage post-storm. These projects are often promoted and subsidized by the Louisiana Department of Insurance, as well as in other at-risk states.

The new working groups

The Pre-Disaster Mitigation & Risk Modeling Working Group will:

A. Create and coordinate resilience tools to assist state regulators in developing, enhancing, and maintaining state-based mitigation grant programs, ensuring consistency while allowing for state-specific adaptations to local priorities.

B. Analyze how natural catastrophe models assess risks to identify priority areas for community risk mitigation and advocate for additional funding.

C. Collaborate with the NAIC Catastrophe Risk Management Center of Excellence (CAT COE) to establish research priorities in risk and mitigation, analyze long-term scenarios and strategies related to insurer solvency, provide specific training on catastrophe modeling and reinsurance strategies, and enhance communication regarding risk reduction.

D. Develop formal coordination protocols between state departments of insurance and their respective State Emergency Management Agencies (SEMAs), recognizing SEMAs as primary applicants for FEMA pre-disaster mitigation grant programs (e.g., BRIC). This includes jointly identifying insurance-relevant mitigation priorities, aligning project proposals with insurance market objectives, and coordinating participation in FEMA grant application processes.

E. Build partnerships with stakeholders involved in implementing and supporting risk mitigation actions.

F. Create communication materials addressing adaptation, resilience, and mitigation issues and solutions.

The Severe Peril Working Group will:

A. Examine, analyze, and monitor insurance protection gaps by peril, including hurricanes, wildfires, atmospheric rivers, and severe convective storms, as well as overall market conditions in current and potential future scenarios.

B. Track the emergence of innovative insurance policy solutions, such as inclusive and parametric insurance products, that enhance resilience to natural catastrophes and address identified protection gaps and insurance market issues.

C. Leverage the experiences of insurance regulators regarding specific perils to share knowledge with fellow state regulators and future commissioners.

D. Launch a national initiative to raise awareness of flood risk and risk mitigation strategies, incorporating the latest scientific research, technology, and mitigation efforts, along with available flood insurance options.

E. Establish partnerships with national and international non-governmental organizations and universities to create innovative recovery and rebuilding programs targeting underinsured or uninsured communities.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post NAIC counters climate impacts with new working groups, risk dashboard appeared first on Insurance News | InsuranceNewsNet.