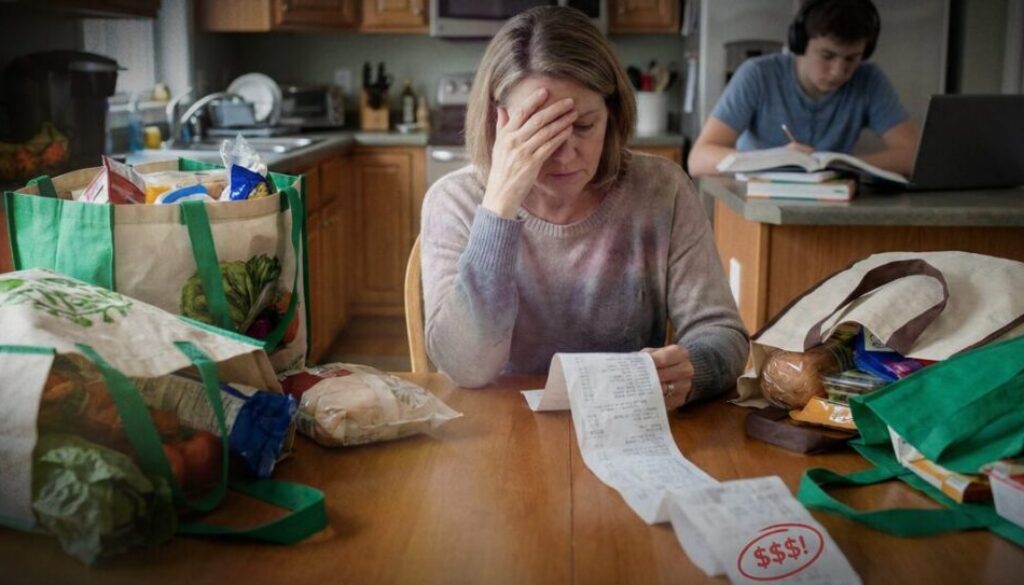

Middle-class households face worsening cost pressures

Middle-class households face worsening cost pressures for the first time since October 2024, the first time the American Council of Life Insurers conducted its Financial Resilience Index.

ACLI recently announced the results of its January Financial Resilience Index, which measures middle-class (making between $50,000-$150,000 in annual income) households’ abilities to manage financial challenges and plan for a stable future.

ACLI began conducting its study in October 2024, and the January index looked at data from the third quarter of 2025.

The financial resilience index also found that more than four in 10 (42%) middle-class households are not confident that they could pay an unexpected expense of $5,000 and bounce back financially.

“While resources, like income, improved slightly, higher costs for daily essentials and modest luxuries weighed on consumers’ finances,” according to David Chavern, ACLI president and CEO. “Middle-class households are not very or not at all confident that they could pay for an unexpected expense like a car repair or broken appliance and recover financially.”

Despite these pressures, middle-class households are taking some steps to improve or maintain financial stability, but there is room for improvement. Just over half (52%) of middle-class households are putting money into a savings account and almost six in 10 (58%) said they are paying off debt or making debt payments.

Many middle-class households remain underinsured

The study also found that many households remain underinsured, with respondents noting that those with children under 18 are no more likely than other middle-class households to say they maintain life insurance coverage (33% versus 31%).

“The survey finding reinforces something we’ve known for a long time – many families are underinsured. The work the financial services industry does to give families the financial protection they need is crucial, now more than ever,” Chavern said.

Financial confidence varies by generation. Middle-class respondents in Generation Z are the least likely to be very confident and baby boomers are by far the most likely to be very confident (16% of Gen Z; 22% of millennials; 23% of Generation X; 40% of boomers and older).

Within the middle class, a much higher share of Gen Z respondents (44%) say they are investing to improve or maintain their household’s financial stability, compared with all other generations in aggregate (33%).

“Gen Z has had less time to build savings and assets, and they’ve come of age during a period of economic volatility and high costs. They feel financial swings more sharply because their buffers are smaller. That naturally leads to lower confidence, even when broader economic indicators are steady,” Chavern noted.

© Entire contents copyright 2026 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Middle-class households face worsening cost pressures appeared first on Insurance News | InsuranceNewsNet.