Lincoln Financial execs hail strong annuity sales; life business in ‘transition’

Like its competitors, Lincoln Financial is riding huge annuity sales while setting up Bermuda reinsurance and watching interest rates.

Lincoln executives mostly found the right formula to end 2024 on a positive financial wave. CEO Ellen Cooper and her team met with Wall Street analysts Thursday to discuss quarterly and full-year results.

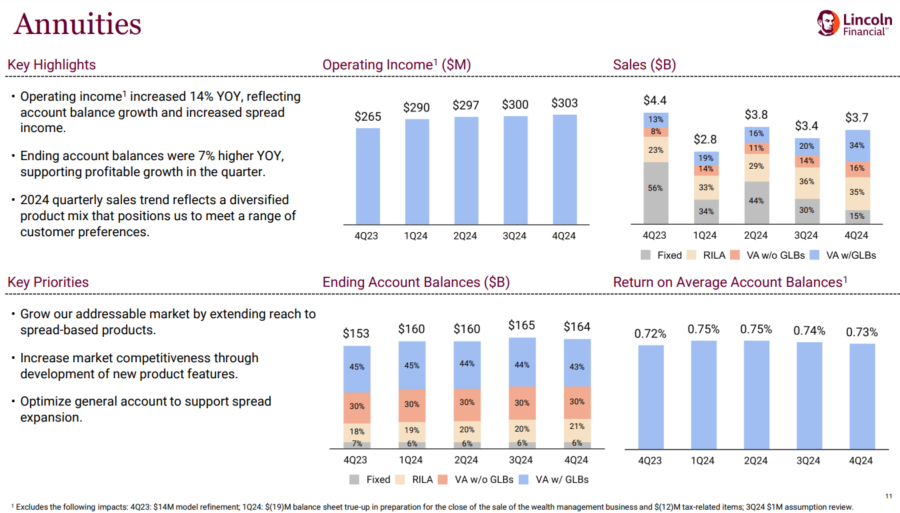

The Radnor, Pa.-based insurer reported net income of $1.7 billion for Q4, boosted by strong returns from its Group Protection and Annuities segments. Lincoln saw its highest full-year annuity sales since 2019.

“We continue to strengthen our annuities business, positioning it for additional growth by emphasizing a more diversified product mix,” Cooper said. “This is a key competitive strength enabling us to be a holistic solutions provider that can adapt the customer preferences in various market environments.”

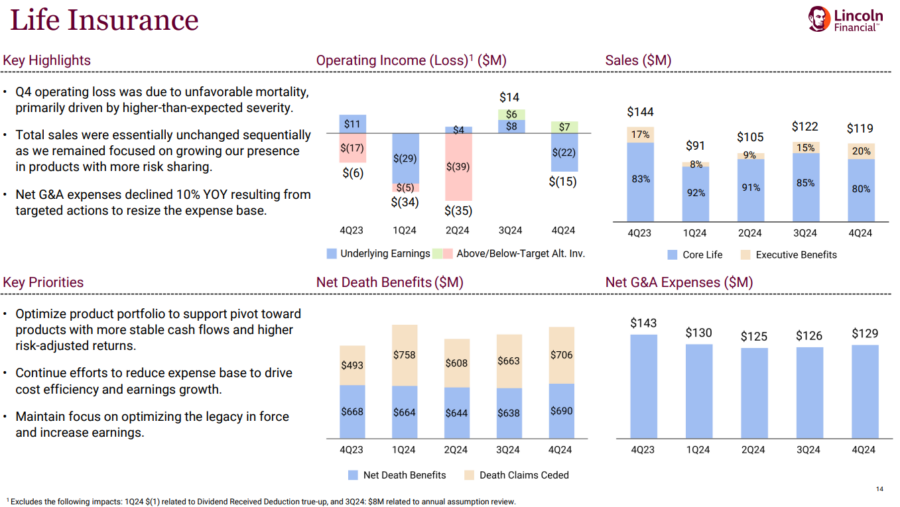

The good annuity news was offset by a $15 million quarterly loss from the Life Insurance segment. Executives partly blamed the impacts of a 2023 reinsurance agreement with Fortitude Re. Starting this year, year-over-year financial comparisons will no longer be impacted by that transaction, noted Christopher Neczypor, chief financial officer.

Secondly, higher mortality rates also sent life insurance losses higher.

“This quarter, we experienced elevated mortality driven by large claims, leading to an outsized impact,” Neczypor said. “While volatility like this can occur from time to time, this was unusual quarter, and we would not expect this level of severity on a go-forward basis.”

2024 was a year of “substantial transition” in the Lincoln life business, Cooper said.

“We are refocusing this business to deliver accumulation and protection products with more risk sharing,” she explained. “We are currently in these markets today and have been building out additional product features to expand our solution set and position us for future profitable growth.”

In Other News

First Alpine Reinsurance deal. Lincoln launched its Bermuda-based reinsurance subsidiary, Alpine Reinsurance, announced during the Q2 earnings call, and completed its first deal, Neczypor said.

“We received approval for our first internal flow agreement with our Bermuda-based affiliated reinsurer, Alpine, focused on fixed annuities,” he said. “Optimizing our internal and external reinsurance mix is a key focus for 2025 with the net benefit being the growth of spread-based account balances and earnings over time, all while maintaining our required product returns.”

Quarterly Snapshot

- Retirement Plan Services achieved 10th consecutive year of positive flows and saw a 25% increase in deposits in 2024

- Risk-based capital ratio exceeded 430%, giving Lincoln a strong capital position

- Group Protection earnings doubled year over year in Q4

- Highest annuity sales in five years

Management Perspective

“We delivered strong results with full-year adjusted operating income increasing to its highest level in three years. We outperformed relative to the financial objectives we established last year and built substantial momentum across our businesses, increasing our confidence in our longer-term outlook.”

– CEO Ellen Cooper

By The Numbers

- Total Revenue: Adjusted operating income $332 million ($252 million in Q4 2023)

- Net Income: Net income of $1.7 billion ($1.2 billion in Q4 2023)

- Earnings Per Share: Adjusted income per diluted share was $1.91 ($1.47 in Q4 2023)

- Stock Price Movement: Shares up 5% at midday Thursday to $35.52

Life Picture

– Revenues: $1.6 billion ($1.7 billion in Q4 2023)

– Operating Income: $15 million loss ($6 million loss in Q4 2023)

– Sales: $119 million ($144 million in Q4 2023)

Annuity Picture

– Revenues: $1.2 billion ($525 million loss in Q4 2023)

– Operating Income: $303 million ($279 million in Q4 2023)

– Sales: $3.7 billion ($4.4 billion in Q4 2023)

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Lincoln Financial execs hail strong annuity sales; life business in ‘transition’ appeared first on Insurance News | InsuranceNewsNet.