Legislators ‘greatly disturbed’ by Trump order hijacking oversight of AI

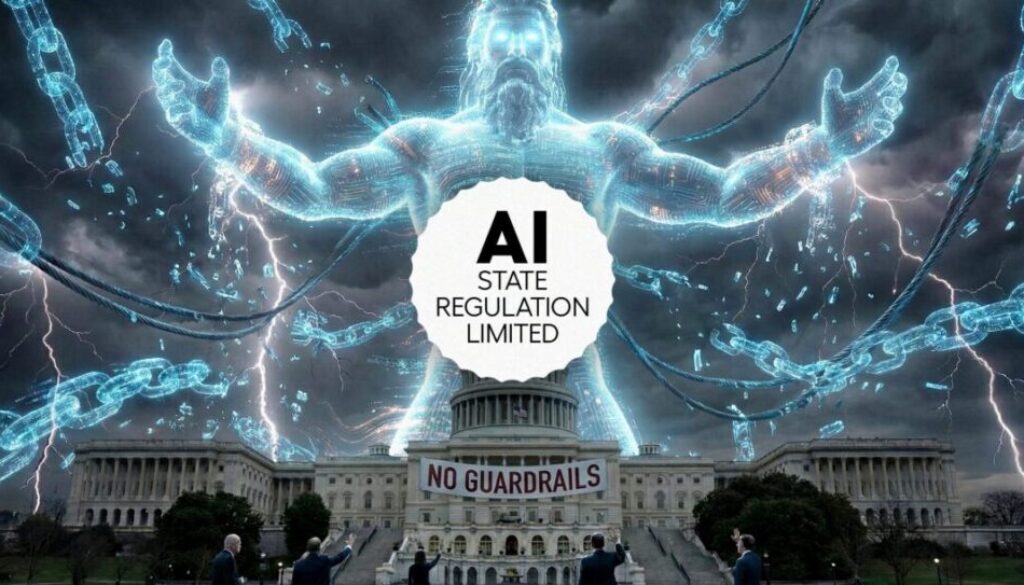

An executive order on artificial intelligence issued by President Donald Trump on Thursday is not going over well with state lawmakers and regulators.

Oversight of the insurance business is entirely within state control, say leaders of the National Association of Insurance Commissioners and the National Council of Insurance Legislators.

Those two organizations don’t always get along, but they are unified on this issue. Trump’s executive order — titled Ensuring a National Policy Framework for Artificial Intelligence — seeks to preempt state laws and regulations on AI.

“[W]e are greatly disturbed with the recently signed Executive Order that aims to limit the ability of States to regulate artificial intelligence,” NCOIL said in a statement. “[I]t’s vital that state legislators have the ability to develop policy that protects our constituents. Those constituents have been steadfast in asking for safeguards against the current unknowns surrounding AI, and it’s important that they not be deprived of state-based policy solutions.”

NCOIL is comprised of state legislators who serve on insurance committees within their state legislative body. In May, the organization spoke out when a proposed 10-year moratorium on state authority over AI was being considered by Congress.

That measure was decisively rejected and removed by the Senate in a near-unanimous 99-1 vote in July.

The NAIC wrapped up its fall meeting in Hollywood, Fla. last week. Iowa Insurance Commissioner Doug Ommen is especially outspoken about federal attempts to encroach on state oversight of insurance.

During a Big Data and Artificial Intelligence Working Group meeting four days before the Trump executive order, Ommen addressed the issue again.

‘Confident’ in state insurance commissioners

“We’re confident the state insurance commissioners’ authority to coordinate efforts to supervise AI, consistent with one another, is necessary, effective and consistent with federal law,” Ommen said. “Clearly, any attempt to prevent us from doing our work here would impact consumers negatively and represent a significant departure from our state regulatory system that’s worked for over 150 years.”

The NAIC released a more detailed statement Tuesday, saying that Trump’s executive order “creates significant unintended consequences.”

“This could implicate routine analytical tools insurers use every day and prevent regulators from addressing risks in areas like rate setting, underwriting, and claims processing—even when no true AI is involved,” the statement said.

The EO “could disrupt well-established processes that ensure fairness and transparency in insurance markets and safeguard consumers from unfair or discriminatory practices. It introduces legal uncertainty, which may weaken the insurance market by delaying business decisions, deterring investment, and postponing essential consumer protections,” the statement continued.

A deregulatory stance

The Trump EO is a deregulatory move with a view “that state-level safety, bias-mitigation, and transparency requirements risk imposing ideologically driven constraints on AI outputs and hamstringing the innovation needed for the United States to win the AI race,” the law firm Gibson Dunn concluded in a client alert.

The EO explicitly calls out Colorado’s AI Act as an example of a problematic state law, the law firm noted.

Colorado’s AI regulation for the insurance industry aims to prevent unfair discrimination based on protected classes when using AI, algorithms, and external consumer data. It is considered one of the toughest and most comprehensive laws to date.

Trump’s order “directs the Attorney General to establish an AI Litigation Task Force . . . whose sole responsibility shall be to challenge State AI laws.”

Gibson Dunn takes a dim view of the EO’s chances of superseding state authority over AI.

“[T]he likely bases that the DOJ would have to challenge state AI laws are those stated in the EO: preemption or unconstitutional regulation of interstate commerce,” Gibson Dunn writes. “Neither would likely succeed.”

Business as usual

Meanwhile, NCOIL and the NAIC are moving ahead with their own model rules for AI regulation.

In December 2023, the NAIC adopted the Model Bulletin on the Use of Algorithms, Predictive Models, and Artificial Intelligence Systems by Insurers.

The bulletin is not a model law or a regulation. It is intended to “guide insurers to employ AI consistent with existing market conduct, corporate governance, and unfair and deceptive trade practice laws,” the law firm Troutman Pepper Locke explained.

And NCOIL stepped up this summer with the NCOIL Model Act Regarding Insurers’ Use of Artificial Intelligence.

Assemblyman Jarett Gandolfo of New York said the AI work gave NCOIL the chance to “provide leadership and guidance to the legislatures that are continuing to discuss AI and most appropriate policy framework.” The NCOIL model has not been finalized yet.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Legislators ‘greatly disturbed’ by Trump order hijacking oversight of AI appeared first on Insurance News | InsuranceNewsNet.