Is long-awaited insurance industry transformation arriving — finally?

The insurance industry is often said to evolve slowly — until it doesn’t. According to two new reports, that moment of rapid insurance industry transformation may be arriving now.

TransUnion’s Q2 2025 Personal Lines Trends and Perspectives report shows a near-term market in flux. Auto insurers are breathing a sigh of relief as profitability returns, while property carriers continue to struggle under the weight of rising claim costs, catastrophic weather losses, and premium fatigue. Meanwhile, ReSource Pro’s strategic outlook, Insurance in 2035, suggests that many of today’s market dynamics — from consumer shopping behavior to workforce turnover and digital risk exposure — are harbingers of deeper systemic change over the next decade.

Taken together, the two reports draw a picture of an industry straddling the present and the future, challenged to both maintain profitability today and reimagine its structure for tomorrow.

Market ‘clearly in transition’

“The market is clearly in transition,” said Patrick Foy, senior director of P&C market strategy at TransUnion. “Premium increases have likely peaked, but rising costs for imports and auto repairs still threaten future loss ratios.”

After several turbulent years of correcting for underpriced risk, auto insurers have finally turned the corner on profitability. TransUnion’s Q2 report finds that while shopping activity is still elevated — up 10% year-over-year — the rate of premium increase has peaked. The focus is shifting to growth, with carriers ramping up acquisition efforts.

Marketing spend for auto products jumped 35.2% year-over-year in Q4 2024, with digital, email, and search channels seeing double-digit increases. The Northeast, in particular, led the nation in auto shopping activity in early 2025. States like Connecticut, New York, and New Jersey saw double-digit premium increases, prompting consumers to shop aggressively for better deals.

Interestingly, consumers with lower credit-based insurance scores (300–500) led the way in auto policy shopping — a return to a more traditional pattern last seen before the pandemic. The report notes this may reflect a return to risk-based rate segmentation, with higher-risk policies now absorbing the bulk of residual increases.

Loss costs could outpace premiums again

But while rates may have stabilized, cost pressures remain. Imports, parts, and vehicle values continue to rise. TransUnion warns that if those costs aren’t managed carefully, loss costs could once again outpace premiums, especially in the face of a weakening vehicle market. Used vehicle financing declined 5% over two years, and vehicle loan originations remain 15% below 2019 levels. Still, there’s demand ahead — one in four consumers plans to replace their vehicle within 12 months, led by Millennials and Gen Z.

On the property side, it’s a different story. Homeowners insurance shopping increased 5% year-over-year, driven largely by higher-risk customers seeking lower premiums. Those with the lowest credit-based scores (300–500) were more than twice as likely to shop as those with the highest scores (701+), continuing a trend that began in late 2024.

The pressure is understandable. The industry continues to wrestle with combined ratios over 100 as insurers face rising rebuilding costs and a record number of weather-related catastrophes. In 2024 alone, the U.S. experienced 27 separate billion-dollar disaster events, up from an average of 13 in the 2010s, with total insured losses nearing $183 billion.

Replacement costs haven’t kept pace with premiums. Inflationary spikes in the early 2020s, combined with a rebound in material costs like lumber and petroleum, are driving more frequent and more expensive claims. Since 2021, the average homeowners insurance premium has increased by $648 nationwide.

Consumers are more price sensitive

Both reports agree that consumer behavior is becoming more fluid — and more price sensitive. TransUnion’s data show that just 10% of auto insurance switchers cited bundling as their reason for switching, despite carriers’ long-standing reliance on bundling for retention. For homeowners, it was only slightly higher at 15%.

Instead, lower premiums, better coverage, and better service dominated consumer motivations. Telematics is one area where carriers are gaining traction: more than half of shoppers offered usage-based insurance opted in — a figure driven primarily by Gen Z and Millennial policyholders.

At the same time, troubling cracks are appearing: 13% of consumers reported going without auto insurance in the last six months, citing an inability to pay. That figure has held steady for nearly two years, signaling deep financial strain among lower-income and younger drivers.

TransUnion also notes a growing trend of multigenerational households and declining homeownership among younger generations. Only 41% of Millennials owned a home in 2024, compared to 52% of Gen X at the same age. As a result, renters insurance shopping is on the rise as well — up 15.7% year-over-year.

Reports take differing views

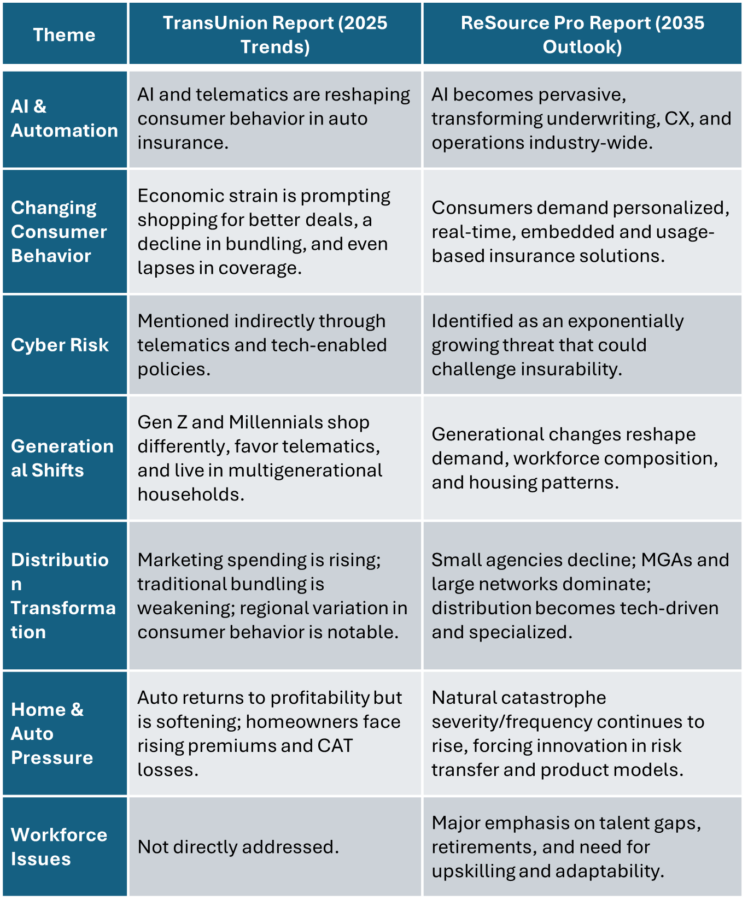

While TransUnion’s report captures the urgency of now, ReSource Pro’s long-range vision shows where these dynamics may be taking the industry, and leading, finally, to insurance industry transformation.

By 2035, the firm expects:

- Cyber risk to grow so complex that insurability could be compromised.

- Embedded, parametric, and on-demand insurance products to become standard offerings.

- AI and agentic automation to fully integrate into underwriting, distribution, and claims.

- MGAs and E&S lines to double in size, driving innovation.

- Small, traditional agencies to fade, replaced by larger, tech-driven super-agencies.

Perhaps most critically, ReSource Pro predicts that insurance workforce roles will undergo a seismic shift, driven by retirements and the need for digital, analytical, and human-centered skills. As automation grows, so too will the demand for professionals who can navigate uncertainty, interpret AI outputs, and manage human relationships. This shift, by necessity, will force insurance industry transformation.

The Resource Pro report a projected gap of 400,000 unfilled insurance jobs by 2035 is forcing the industry to rethink how it attracts talent, boosts productivity, and modernizes operations.

Adaptability will be ‘most important asset’

“Adaptability will be the most important asset any carrier or agency can cultivate,” said Mark Breading, senior partner at ReSource Pro. “The industry won’t just be digitized — it will be redefined.”

For now, insurers are being asked to operate on two timelines: competing in the high-churn, cost-conscious environment of today, while laying the foundation for the digitally integrated, AI-enabled world of tomorrow – driving the insurance industry toward transformation.

That will require investment not just in tools, but in strategy, talent, and organizational flexibility. From telematics to talent development, from rethinking bundling to preparing for quantum computing, the transformation is no longer hypothetical — it’s happening in real time.

The challenge for insurance leaders is clear: Read the signals, anticipate the shifts, and act with urgency. Because what looks like a short-term trend today may be tomorrow’s baseline expectation.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Is long-awaited insurance industry transformation arriving — finally? appeared first on Insurance News | InsuranceNewsNet.