How failure to modernize could be holding insurance companies back

Failure to modernize key back-office operations and embrace new technology that enables efficiency could be holding some insurance companies back, according to new research from data management company AutoRek.

“I think that’s quite often a mindset you see, not just in insurance, but across more traditional businesses in general. But I think there are opportunities out there with automated solutions and cloud opportunities quickly coming down the line,” Mark Baker, a presales consultant at AutoRek with a strong focus on insurance and a qualified accountant, said.

A recent AutoRek study found 21% of American insurance firms have inefficient premium receivables and allocation processes. More than half reported still using legacy spreadsheet tools that require manual input for these processes. According to Baker, this:

- Causes issues with version control

- Is not easily auditable

- Does not lend to scalability

- Is cumbersome and inefficient

Baker noted that American insurance companies tend to give front-office, revenue-generating systems preference when it comes to resources. This could be why many still choose to lean on legacy systems and processes for their back office.

“But as a company grows, it starts to creak, etc., and I think at that point, it’s time to understand that your business, the foundations really come in the back office. If you can then automate those back-office functions, then that just lends itself to supporting the further growth of a business moving forward,” he said.

Back-office processes need to modernize

AutoRek found that, of the challenges American insurers have with back-office processes, the biggest issues are:

- Multiple systems and data sources (39%)

- High volumes of transactions (35%)

- Partial payments and adjustments (33%)

“We found insurers working with vast arrays of different data coming from different systems. Therefore, it’s all in a different format, it’s all got a different column structure, etc. Varying levels of data quality within that. So, as you can imagine, trying to deal with that on a daily basis can be quite cumbersome,” Baker said.

He pointed out that this leaves firms open to “key man risk,” as only the person who set the spreadsheet up would understand those formulas. Additionally, it lacks auditability, as if someone were to change a formula or value in a spreadsheet or cell, none of that may be tracked or recorded in a legacy tool.

How automation fits in

Baker suggested that modernized, automated tools such as service-as-a-software (SaaS) is a key solution.

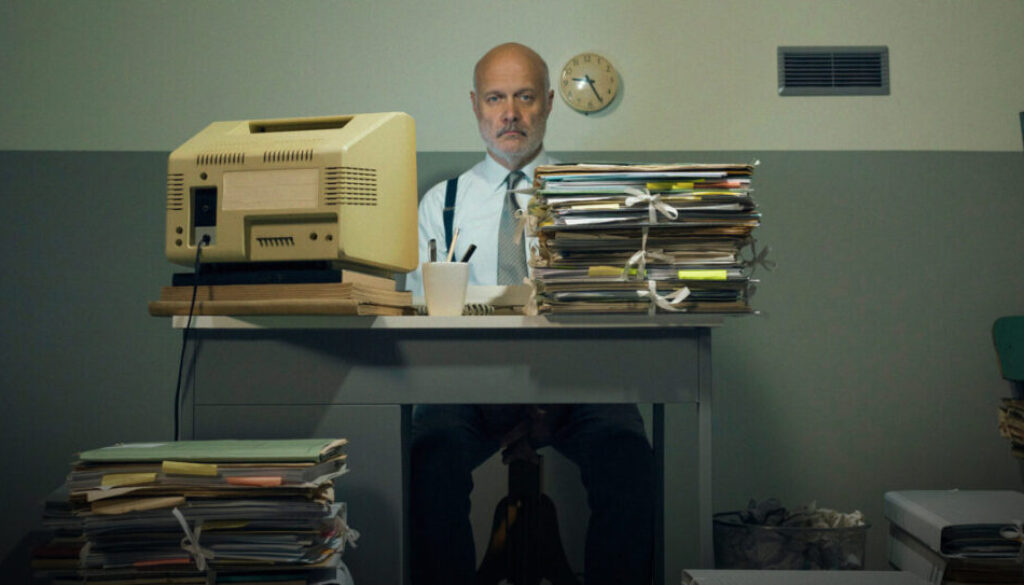

He explained that, in a typical scenario without automation, a back-office employee may start their day by downloading data, manually entering it into a legacy spreadsheet tool and checking the data quality and formulas. In this example, it may be lunchtime before that person has managed to get the data in, and then they still have to find time to perform value-add activities.

“With an automated solution, really high level, it’s bringing up your resources, your people resource predominantly, for more of those value-add activities,” Baker said. “We found that looking to automate and make use of digitizing can lead to huge levels of efficiency savings and allow clients to produce, in effect, a golden record whereby we can standardize data as much as possible.”

A modernized automated SaaS that runs 24/7 could load data into a unified system and process it as soon as it becomes available, Baker noted. Additionally, every action is auditable whether it’s system-driven or user-driven.

“So. if you go and make a coffee and come back to your desk, by that point, the data would have been brought into the system. It would have been validated, checked, matched and then available for all of those investigations to happen. It’s doing more with less,” he said.

Leaving modernization to a vendor

AutoRek is just one of many SaaS solutions available for insurers seeking to modernize and automate their back office processes. It offers a platform that scales to a company’s requirements as the business grows, Baker said.

But, importantly, it shifts management of data to a vendor like AutoRek, who then becomes responsible for deployment, upgrades, maintenance and generally “taking that headache away from the client, where traditionally that would have all been done by an internal IT department.”

“I think that’s some of the benefits of looking at a SaaS solution and also being able to stay on top of software and the latest technology, etc., because all of that’s taken away from the client and it becomes a managed service,” Baker explained.

He noted that while insurers can be hesitant to embrace new technology or modernized solutions, there are benefits to a SaaS solution over more traditional options.

“Everyone’s favorite buzzword at the minute is all the talk around AI and things. I think it always lends itself to being open minded and embracing new opportunities, and sometimes that’s in the technology space,” Baker said.

AutoRek is a global data management company founded in 1994 and based in Glasgow, Scotland. Its software helps automate data reconciliation for financial institutions across the United Kingdom and United States. For the study referenced in this article, AutoRek conducted online interviews with 250 managers of American insurance companies in November 2024.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post How failure to modernize could be holding insurance companies back appeared first on Insurance News | InsuranceNewsNet.