Health insurers face trust crisis, Forrester 2025 survey finds

Health insurers stand at a crossroads as a new study showed consumer trust in them is critically low.

A Forrester Research report showed only 25% of noncustomers and 54% of customers described health insurers as trustworthy.

The 2025 Forrester’s Customer and Brand Experience Survey revealed health insurers scored lowest among businesses surveyed for total customer experience. The survey measures how noncustomers’ and customers’ perceptions of their brand interactions drive loyalty.

“This failing score evidences further deterioration of an essential industry,” the report’s authors wrote. “Health insurers must repair the trust rift with both noncustomers and customers. Consumers are gaining more choice in health care coverage, and employers are placing more emphasis on employee feedback in plan selection, raising the importance of brand perception.”

Gen Z has lowest trust

The level of trust consumers have in a health insurer varies by age group, the study showed. Trust level was lowest among Generation Z consumers, with 35% of that age group reporting they trust their health insurer to keep private information secure, compared with 63% of the silent generation.

“When we’re talking about something that’s as high stakes as your health and your wealth, trust is such an important component,” said Arielle Trzcinski, Forrester principal analyst and one of the study’s authors.

The low percentage of consumers who said they trust their health insurer was not a surprise to her.

“I don’t know that I was surprised that folks don’t trust their health insurer,” she said. “I think it’s a sorry state for us to be in as an industry as we think about, how we ensure that we’re helping folks.

“We hire a health insurer to help mitigate the financial risk of getting health care services, and we’re not seeing them do that. So they haven’t earned consumers’ trust when they’re creating more processes that delay care and make it harder to get to the care that they need. We have a lot of work to do within the health insurance industry.”

Consumers want clear answers from health insurers

Addressing customer questions with clear answers was the top driver of consumer and brand loyalty toward health insurers. Other top drivers included keeping personal and financial information secure, helping the customer manage their health care, offering the kind of plan and services needed, and resolving issues the first time.

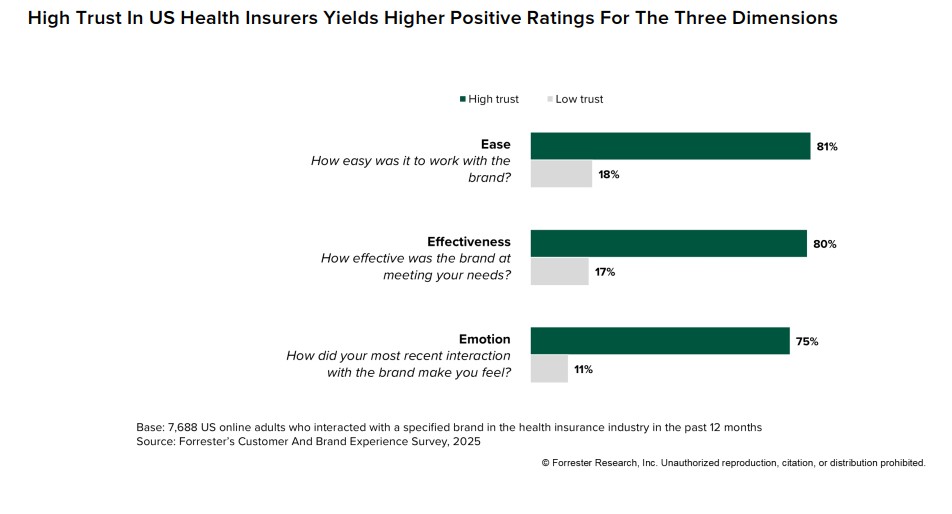

The study evaluated three customer experience dimensions: ease, effectiveness and emotion. Among respondents who interacted with a specified health insurance brand in the past 12 months, high-trust health insurance customers gave significantly higher ratings than their low-trust counterparts: approximately 4.6 times higher for ease and effectiveness and 6.8 times higher for emotion.

Consumers with high trust in their health insurer are 6.8 times more likely to feel valued than those with low trust. But negative emotions are also amplified by the level of trust. Customers with low trust are nearly 12 times more likely to feel “frustrated,” the emotion with the most detrimental impact on the perception of customer experience quality. These low-trust customers are also 14 times more likely to feel disappointed than those with high trust. There is a tight relationship between trust and the emotions that support or erode loyalty and enrichment in the customer relationship.

High-trust customers willing to pay a premium

Trust differentiates health insurance brands in meaningful ways, the study said. Brand performance pressure rises as customers’ options for brands and products increase — whether through their employer, the individual market or Medicare-related products. High trust creates significant lifts for health insurers: 65% of high-trust customers report that their health insurer distinguishes itself from its competitors; 53% of high-trust customers say that they would pay a premium for their health insurer’s products and services.

The study also showed that trust boosts customer retention. About two-thirds of consumers surveyed said they prefer to shop for their own plan and choose the options that best suit their needs, compared with just 25% who prefer their employer to choose options for them. Among consumers who interacted with a health insurer in the past 12 months, low-trust health insurance customers are 10.3 times more likely to leave their current brand than their high-trust peers. This is a noticeable jump from Forrester’s 2024 data, which found that low-trust customers were 2.4 times more likely to switch insurers.

Insurers’ poor performance on a core function like “processes transactions quickly” became a top factor in the quality of customer experience in recent years, along with denials and delays of care.

Trust turns up the volume on brands, the study showed, with 82% of high-trust customers likely to recommend the brand to a friend or family member looking to purchase the product or service, compared with only 5% of low-trust customers. This is another dramatic shift from Forrester’s 2024 study, which showed that among those who interacted with a specified health insurance brand in the past 12 months, 48% of low-trust customers would recommend the brand.

Customers ranked competence as their top trust factor when describing what makes them trust their health insurer. Other trust factors, in order, were: dependability, accountability, consistency, integrity, empathy and transparency.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Health insurers face trust crisis, Forrester 2025 survey finds appeared first on Insurance News | InsuranceNewsNet.