NAIC’s 2026 AI evaluation pilot moves ahead as industry balks

It will take more drafts to get an AI system evaluation tool to the finish line, but state insurance regulators are committed to kicking off a pilot program in 2026 to test insurers’ use of artificial intelligence.

Still, the project is being heavily criticized by industry trade groups.

Ten insurance companies are set to participate in the pilot, said Iowa Insurance Commissioner Doug Ommen during a Sunday meeting of the Big Data and Artificial Intelligence Working Group.

Ommen filled in for Pennsylvania Insurance Commissioner Michael Humphreys to chair the working group meeting. Regulators met in Florida this week for the National Association of Insurance Commissioners’ fall meeting.

Regulators are still determining the structure of the pilot. But it will be followed by an evaluation period to help refine the AI systems tool, Ommen said.

“At the conclusion of the pilot period, we’ll then hear from the pilot group and consider lessons learned from this tool and consider refinements,” he said. “It’s important to understand that the pilot itself will be very instructive.”

The working group proposed the AI Systems Evaluation Tool over the summer. Regulators are not required to use it, but it is another option when performing market conduct exams, Ommen said.

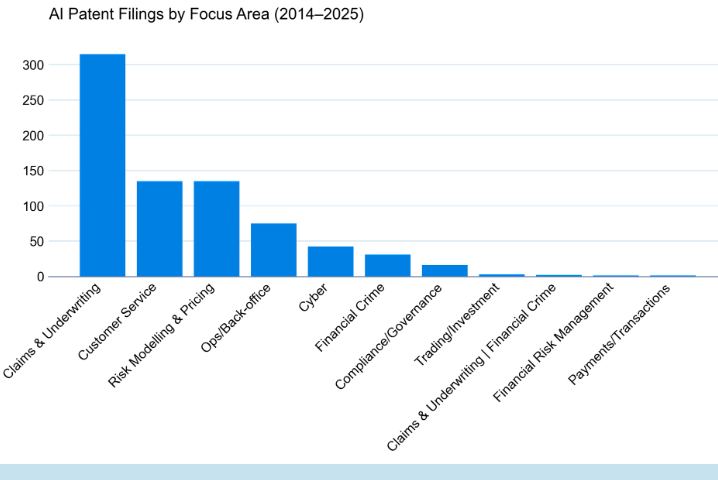

Insurance companies have steadily expanded their use of artificial intelligence over the past decade, moving from basic automation to more sophisticated applications throughout the insurance value chain. More recently, generative AI and advanced automation have reshaped how insurers engage with customers and manage internal operations.

Through it all, NAIC regulators have struggled to establish guardrails to preserve fairness, transparency, and consumer protection.

In December 2023, the NAIC adopted the Model Bulletin on the Use of Algorithms, Predictive Models, and Artificial Intelligence Systems by Insurers.

The bulletin is not a model law or a regulation. It is intended to “guide insurers to employ AI consistent with existing market conduct, corporate governance, and unfair and deceptive trade practice laws,” the law firm Troutman Pepper Locke explained.

But while the NAIC has shied away from any prescriptive model on the use of AI, some states went forward and wrote their own rules. And the National Council of Insurance Legislators stepped up this summer with the NCOIL Model Act Regarding Insurers’ Use of Artificial Intelligence.

Assemblyman Jarett Gandolfo of New York said the AI work gave NCOIL the chance to “provide leadership and guidance to the legislatures that are continuing to discuss AI and most appropriate policy framework.” The NCOIL model has not been finalized yet.

Letter: Make AI pilot voluntary

The NAIC working group spent several hours going over the Nov. 19 second draft of its AI evaluation tool line by line. Several comment letters were shared as well, including a joint letter signed by trade groups representing life, health, P&C, mutual and reinsurance insurers.

“The industry remains significantly concerned about the lack of detail and guidance around the

proposed pilot,” the Dec. 5 letter reads.

Concerns include:

- The Pilot is one-sided, voluntary for regulators while compulsory for companies.

- The Pilot lacks a defined duration.

- The Tool can be used in either a financial and/or a market conduct exam.

- Companies can apparently be penalized for any “negative” findings based on the data gathered via the Tool in the Pilot phase; and

- As we understand it, the Pilot may begin before the final version of the Tool is exposed for comments.

The joint letter referenced several pilot efforts utilized over the years by the NAIC, and urged regulators to follow the process used previously.

“[W]e recommend company participation be voluntary and that information gathered be for development of the tool only and not for compliance purposes,” the letter reads.

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post NAIC’s 2026 AI evaluation pilot moves ahead as industry balks appeared first on Insurance News | InsuranceNewsNet.