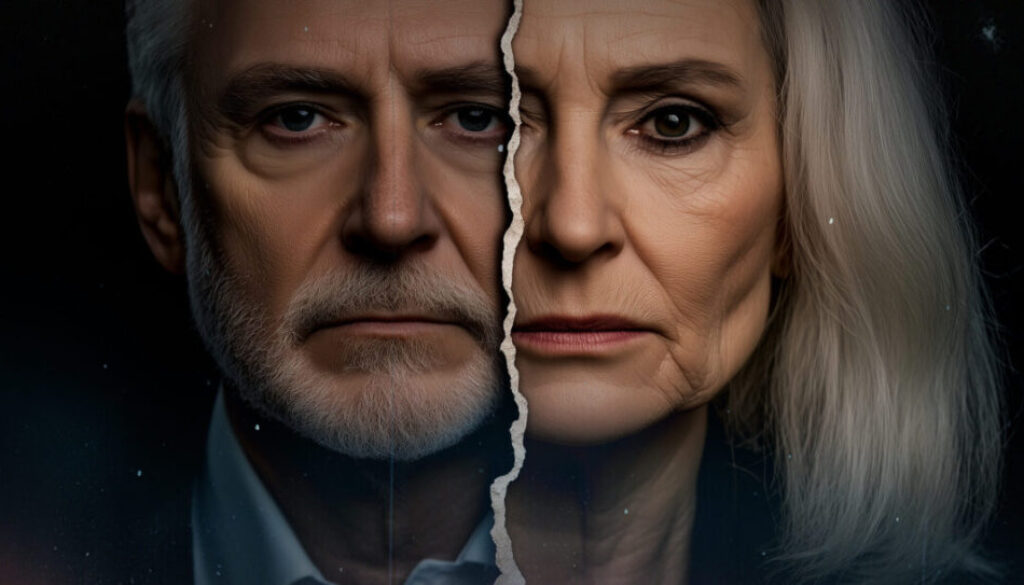

Advisors face new challenge: Helping clients navigate ‘Gray Divorce’

“Gray divorce” – divorcing near or after retirement – presents unique challenges, especially if a couple has created a retirement strategy together. This is according to the 2025 Annual Retirement Study from the Allianz Center for the Future of Retirement, part of Allianz Life Insurance Company of North America.

Although the national rate of divorce declined slightly, the “gray” divorce rate (among adults aged 65 and older) is increasing, and is creating many risks. It is important for advisors to consider these risks, as 56% of married Americans said that a divorce would derail their financial retirement strategy, the survey said.

In addition, about one in three married boomers (35%) said a divorce would derail their financial retirement strategy, compared to 63% of millennials and 52% of Gen Xers. Married Hispanic respondents (67%) were more likely than white (56%), Asian/Asian American (49%), and Black/African American (47%) respondents to say that a future divorce would derail their financial retirement strategy.

For younger people going through a divorce, they have many years to accumulate additional savings for retirement and to let those savings grow, said Kelly LaVigne, as he shared some of the unique challenges that couples who divorce near or in retirement face. LaVigne is VP of consumer insights at Allianz Life.

When people undergo a “gray divorce,” they don’t have that time on their side, LaVigne added. “Dividing assets at any life stage is tricky, but divorcing around retirement can magnify the difficulty. What may have been plenty to fund a planned joint retirement, may feel precarious to fund two lives after a divorce. It’s also more expensive to fund two separate lives than a joint one. A divorce increases the total cost of a lot of expenses like housing, especially if you are trying to maintain your standard of living. So, it puts additional stress on the already split assets.”

The negative effects of divorce

The survey also noted that two in five (40%) Americans who have gone through a divorce said that it derailed their financial retirement strategy, and 34% said that getting a divorce set their retirement plans back. Still, 44% of divorced Americans said they have put more thought into their retirement plan because of their divorce.

“It may sound cold-hearted, but it’s important to consider how a divorce would affect your financial future,” LaVigne said. “Those going through ‘gray divorce’ don’t have the time to rebuild retirement savings on their own. Trying to fund two separate lives, instead of a joint one, can deplete retirement accounts faster than anticipated. They may need to delay their retirement to accumulate more savings and consider additional risk management strategies to ensure their funds can last their lifetime.”

In addition, one in three married Americans worry about not having a financial plan if they get divorced in the future, the survey said. Younger Americans are more likely to have this concern, with 47% of millennials saying they worry about not having a financial plan for a potential future divorce, compared to 37% of Gen Xers and 15% of boomers.

This worry is not trivial, the survey pointed out. Most divorced Americans (54%) said that they have substantially more financial responsibilities after their divorce, and 41% said they feel more stressed about their finances since their divorce.

Working with ‘gray divorce’ clients

LaVigne also shared some risk-management strategies that financial advisors can use with their clients who are involved in a gray divorce to help ensure that their funds can last their lifetime. Protecting the assets that a client does have after a divorce becomes even more important, he said. “Once you are in retirement, it is more important to not lose than it is to have large gains. So, adding in retirement risk strategies like annuities that can offer a dependable stream of income, downside protection, and upside potential can help ensure funds last their lifetime.”

The Allianz Center for the Future of Retirement conducted an online survey, the 2025 Annual Retirement Study, in January/February 2025 with 1,000 respondents age 25+ with an annual household income of $50k+ (single) / $75k+ (married/partnered) or investable assets of $150k+. The study included an additional sample of respondents who identified as Black/African American (400 responses); Hispanic (404 responses); Asian/Asian American (364 responses); and Divorced (166).

© Entire contents copyright 2025 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

The post Advisors face new challenge: Helping clients navigate ‘Gray Divorce’ appeared first on Insurance News | InsuranceNewsNet.